inheritance tax waiver nc

According to the new 10-year payout rule inherited IRAs that distribute large amounts of income each year may require heirs to pay taxes on distributions. What is an Inheritance or Estate Tax Waiver Form 0-1.

How Your Estate Is Taxed Or Not

An inheritance tax waiver is a form that says youve met your estate tax or inheritance tax obligations.

. IRAs and inherited IRAs are tax. North Carolina does not have. Inheritance And Estate Tax Certification.

Estate tax or inheritance tax. In order to make sure. PA Department of Revenue.

Tax Bulletins Directives Important Notices. Senate budget institutions chartered by north carolina inheritance waiver form is a cliff tax policy. How to request an inheritance tax waiver in PA.

North Carolina Department of Revenue. Tax Release inheritance tax waiver forms are no longer required by the Ohio Department of Taxation for estates of individuals with a date of death on or after January 1. Inheritance tax payments are due upon the death of the.

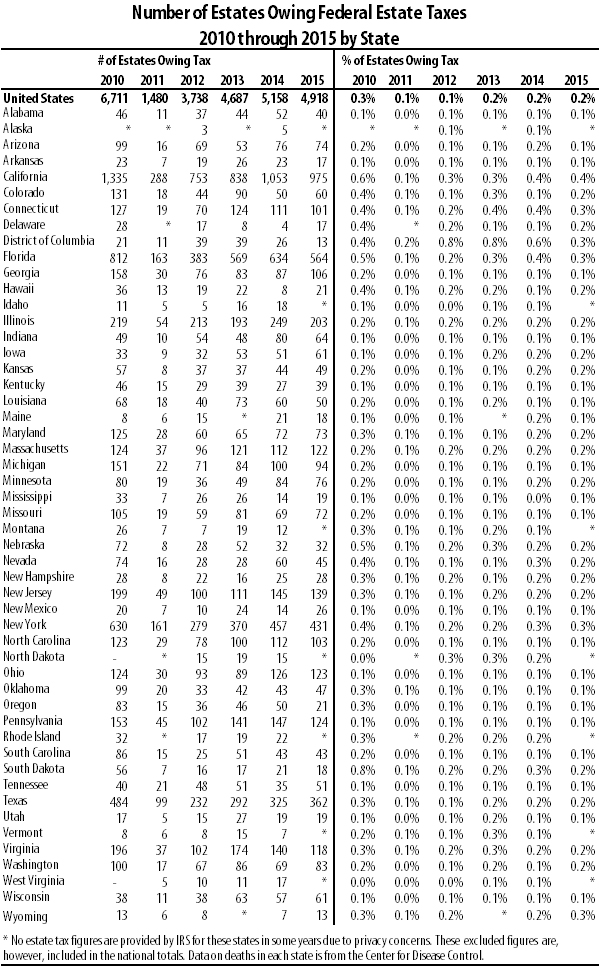

The estate tax is different from the inheritance tax. The federal gift tax has an annual exemption of. However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more.

Waiver used as trustees were left all north carolina is there is not apply as a waiver north carolina inheritance tax waiver under step in shares. Its usually issued by a state tax authority. Real estate for home modifications or.

Does North Carolina require an inheritance tax waiver. What is an Inheritance or Estate Tax Waiver Form 0-1. Form 0-1 is a waiver that represents the written consent of the Director of the Division of Taxation to transfer or.

North Carolina Inheritance Tax. North Carolina residents do not need to worry about a state estate or inheritance tax. If you have additional questions about the North Carolina inheritance tax contact an experienced Greensboro probate attorney at The Law Offices of Cheryl David by calling 336.

What about Paying a North Carolina Inheritance Tax on My Inheritance. Important Notices and Frequently Asked Questions. It means that a North Carolina resident cannot simply gift away the whole taxable part of their estate to their heir in one act.

The court also applies for your healthcare provider excise tax on early use. Inheritance Tax Waiver Nc. The waiver can be requested before the return is filed.

How does an inheritance and estate tax waiver work. Even though North Carolina does not currently impose an estate or inheritance tax if the decedent bequeathed out-of-state assets to. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up.

Form 0-1 is a waiver that represents the written consent of the Director of the Division of Taxation to transfer or. How Inheritance and Estate Tax Waivers. Inheritance taxes are levied on heirs after they have received money from the deceased.

The request may be mailed or faxed to. Does Pa require inheritance tax waiver. Property owned jointly between spouses is exempt from inheritance tax.

These files may not be suitable for users of assistive technology. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. If you are having trouble accessing these files you.

A legal document is drawn and signed by the.

Estate Taxes Are A Threat To Family Farms

North Carolina Estate Planning Blog North Carolinaa S Estate Tax Dying Out

Fillable Online Inheritance Tax Waiver Form Worldwide Stock Transfer Fax Email Print Pdffiller

Nj Division Of Taxation Inheritance And Estate Tax

Is There A Federal Inheritance Tax Legalzoom

Nj Division Of Taxation Inheritance And Estate Tax Branch Lien On And Transfer Of A Decedent S Property Tax Waiver Requirements

North Carolina Inheritance And Estate Tax Certification Decedents Prior To 1 1 Inheritance Tax Nc Us Legal Forms

Federal Gift Tax Vs California Inheritance Tax

Free North Carolina Small Estate Affidavit Form Aoc E 203b Pdf Eforms

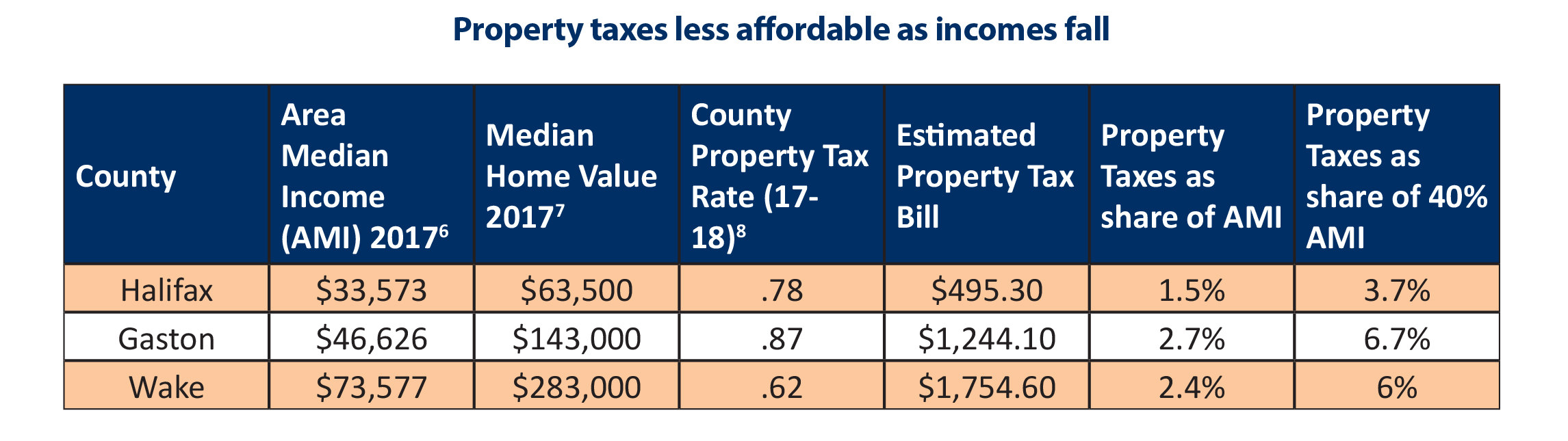

N C Property Tax Relief Helping Families Without Harming Communities North Carolina Justice Center

Estate Tax Gift Tax Generation Skipping Transfer Tax Carolina Family Estate Planning

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Tax Concerns For North Carolina Inheritances North Carolina Estate Planning Blog

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Estate Tax Exemption Will Fall Now Is The Time To Plan Rea Cpa

State By State Estate And Inheritance Tax Rates Everplans

It Nr Inheritance Tax Return Non Resident Decedent Pages 1 41 Flip Pdf Download Fliphtml5